On January 20, 2025, the Chinese government officially launched a new round of consumer subsidy policies, including smartphones, tablets and smart watches in the subsidy scope, and providing subsidies at 15% of the selling price (up to 500rmb per piece). This policy directly reduces consumers' replacement costs, activates mid-range market demand, and adds vitality to the consumer electronics industry chain.

1) Accelerate the popularization of AMOLED screens and promote LCD production capacity upgrades

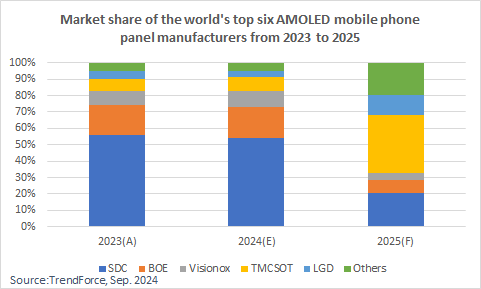

TrendForce pointed out that AMOLED panels have become the mainstream display technology for smartphones, and its penetration rate will increase by 2% to 3% each year, and is expected to reach 68% by 2028. As major mobile phone brands gradually increase the proportion of AMOLED mobile phone panels, shipments are expected to exceed 870 million pieces in 2025, with an annual growth rate of 3.2%.

As demand for low-end LCDs declines, manufacturers such as BOE, TCL, and Huaxing have shifted some LCD production lines to automotive displays, industrial control screens and other fields. In 2025 Q1, domestic LCD mobile phone screen shipments fell 8% year-on-year, but automotive LCDs grew 22% year-on-year.

Overall, under the guidance of the "NCSP”, the panel industry has brought new growth opportunities, especially the market demand for AMOLED panels will continue to rise, driving the panel industry to accelerate recovery.

2) The rise of domestic panel manufacturers, the industrial structure has been adjusted

Under the policy dividend, the performance of domestic panel companies such as BOE and Shenzhen Tianma has improved significantly:

BOE: Turn losses into profits in 2024, the annual shipment of flexible AMOLED will reach 140 million pieces, and it is planned to mass produce the 8.6th generation AMOLED production line in 2026

Shenzhen Tianma: The profitability of smartphone display business has increased, and the shipment of AMOLED products has increased year-on-year. Korean manufacturers (such as LGD) gradually withdraw from the LCD field, and TCL Huaxing acquired LGD's Guangzhou factory for 13.4 billion RMB to further concentrate market share (TV panel supply share exceeds 25%).

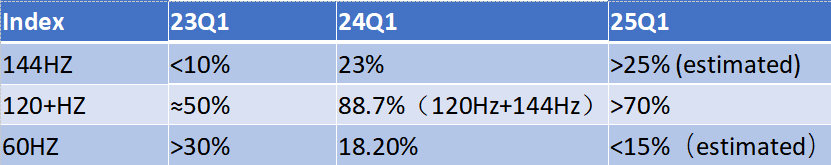

3) Popularization of high refresh rate, LTPO and other high-end technologies

The national subsidy policy has reduced the purchase cost of high refresh rate display equipment, promoting the popularization of high refresh rate from "game exclusive" to mainstream office and entertainment scenes.

In Q1 2025, the proportion of mobile phone screens with a refresh rate of 120HZ or above will reach 70% (50% in 2023), and high refresh screens will become standard. About 1,000rmb phones will also begin to popularize 90HZ high refresh (such as ZTE A41, Samsung Galaxy A06 5G, OPPO K9x, etc.), and the localization of LTPO (dynamic refresh rate) technology will accelerate. BOE will provide LTPO screens for iPhone 16.

The “NCSP” has surpassed short-term consumption stimulus and has become the core driver of the transformation of the mobile phone screen industry to "high-end + localization". GOOYEE has always kept up with the forefront of the industry, continuously optimized product quality, insisted on providing value to customers, and committed to sharing information to achieve a win-win situation for “suppliers-companies-customers”.